About Us

Financial Information

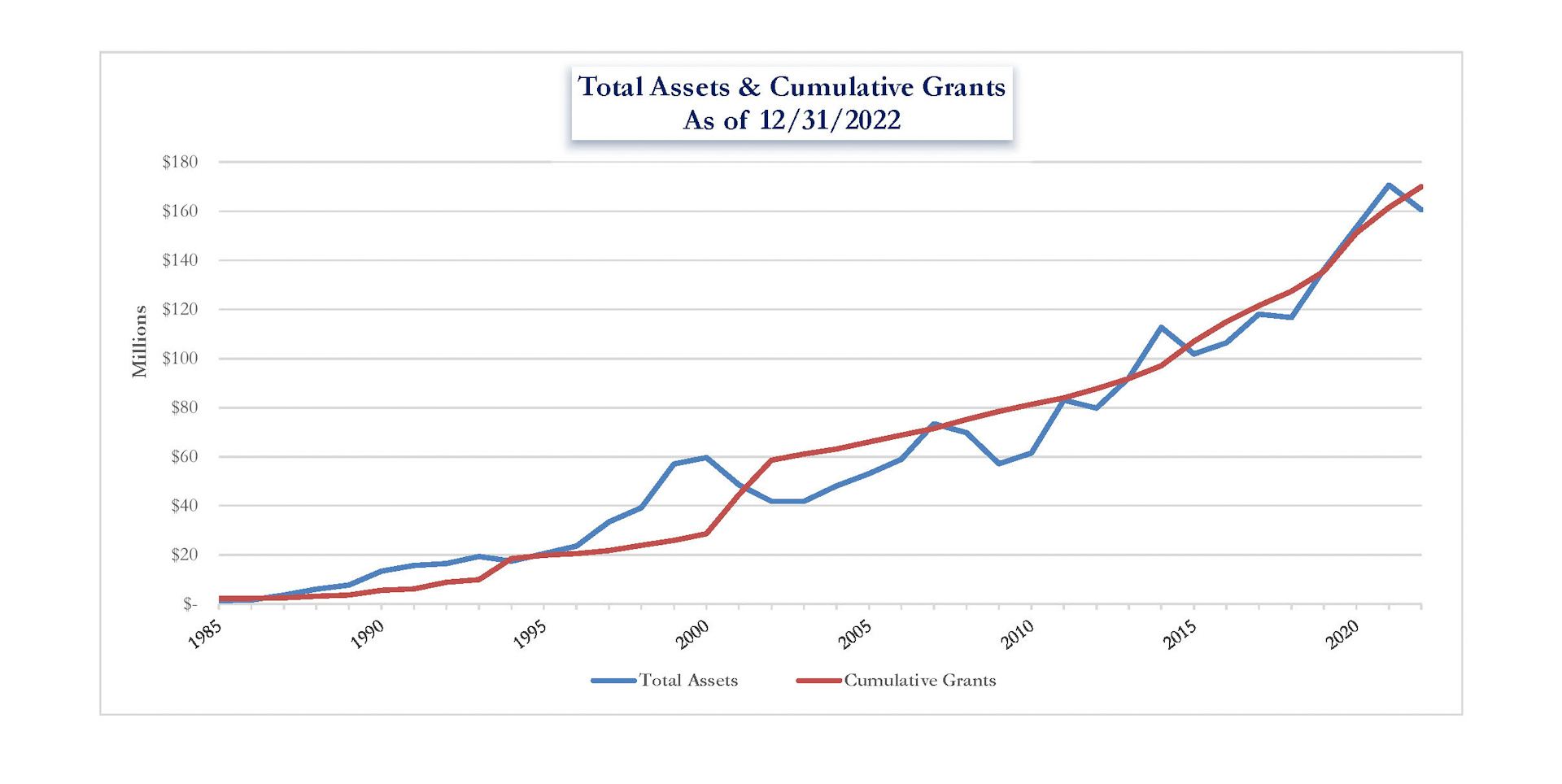

Fund Stewardship

Greater Tacoma Community Foundation was built to support a thriving Pierce County for generations to come.

Two key aspects of GTCF’s fund stewardship ensure sustainability in perpetuity:

1. GTCF’s endowment funds are intended to last forever. We knowingly accept the ups and downs of the market.

2. The members of our investment committee and the money managers responsible for stewarding the investment of our assets have experience navigating a wide range of market conditions.

GTCF’s primary endowment manager, Vanguard, closely monitors global investment markets and remains focused on three broad concepts:

- Monitor market conditions for excessively pessimistic mispricing

- Monitor investment managers to be sure they are responding appropriately to volatility and the higher likelihood of inefficient market pricing

- Seek opportunities to add capital to previously closed managers as openings can be driven by an improved opportunity set and/or decisions by their current investors to withdrawal capital.

In managing the various investment pools, GTCF pursues the following approach:

- Establish a strategic asset allocation which is expected to achieve the long–term return objective of each pool.

- Diversify the portfolio by asset class and strategy as this increases the likelihood of achieving return objectives while managing risk under different economic/market conditions.

- Maintain the strategic asset allocation within established ranges through rigorous monitoring and regular rebalancing. This discipline forces the sale of assets when they are relatively expensive and the purchase of assets when they are relatively cheap.

- Stick with chosen fund managers as long as they remain ethical, have not deviated from their strategy or changed key staff.

- Avoid the temptation to market time or change strategy based on current conditions or near–term outlook.

GTCF’s investment model is based on modern portfolio theory, employing strategically diversified asset allocation. Endowed funds are pooled to provide investment management economies of scale and access to investment vehicles that are unavailable to smaller individual funds.

GTCF’s endowment portfolio employs a diversified growth strategy with the goal of generating a long-term rate of return sufficient to offset inflation, administrative, and management fees, plus regular grantmaking distributions. Grantmaking distributions are currently calculated at 4.3% of the sixteen-quarter rolling average market value for permanently endowed funds.

Overseeing GTCF’s investments is the work of the Investment Committee, which is comprised of experienced professionals with extensive backgrounds in investment and finance. The Committee adheres to disciplined decision-making processes, guided by GTCF’s Investment Policy Statement.