Community

16

In Depth: Impact Investing (Part 4 of 5)

The impact investment story continues! In my last post I shared with you the National Development Council’s efforts to invest half of the Greater Tacoma Community Foundation’s impact investment funds in Pierce County. Now I’d like to introduce you to Craft3, the partner we chose to invest the other half of our initial impact portfolio.

Craft3 is a Community Development Financial Institution (CDFI), founded in Ilwaco, Washington in 1994. Today they have a strong presence throughout our state. Craft3’s mission is strongly aligned with our own: “to strengthen economic, ecological and family resilience in Pacific Northwest communities.” The organization pursues its mission by providing loans to entrepreneurs, nonprofits, individuals and others who don’t normally have access to financing.

This progressive approach to our shared objectives makes Craft3 a natural partner for our impact investment activities.

Craft3 Enters Pierce County

GTCF’s investment has helped Craft3 increase its presence and lending in Pierce County. As Walter Acuna, Vice President, says, “People want to know where [Craft3’s] money comes from… GTCF’s investment allows the community to trust us, it is a great gateway to people.” This is particularly important today, with the spread of online predatory lending which “is hitting Pierce County particularly hard,” Acuna notes.

Craft3 has used this credibility to create a strong network in our community to help identify underserved borrowers who have been unable to secure capital from traditional sources. They have formed a partnership with the City of Tacoma, and developed relationships with the Veterans Incubator for Better Entrepreneurship, VIBE; 1 Million Cups, a program to educate, engage and connect entrepreneurs; SURGEtacoma, a co-working space for entrepreneurs; the Small Business Development Center in Tacoma; and with traditional bankers, to name a few.

“We are marketing strategically. We’re not just hanging out a small business shingle, we’re hanging out an impact shingle,” John Berdes, President & CEO, says of the organization’s approach.

But finding borrowers is just the beginning of Craft3’s work. Once the organization receives a referral, they closely examine the individual or business’s circumstances, need and financial standing. In addition to repayment, Craft3 requires its loans (outputs) to produce measurable outcomes in the following categories: economic, family, and ecological resilience. Berdes acknowledges, “we might not get to as many deals” with such a high bar for impact, but “that is the discipline of knowing what you want to accomplish.”

Local Investments

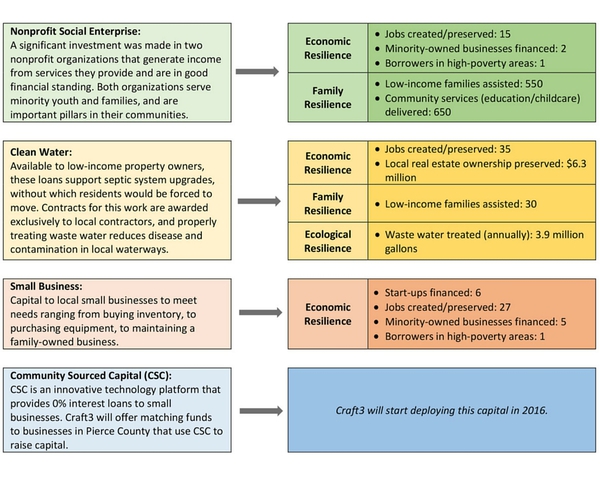

With GTCF’s initial allocation of $750,000, Craft3 has made four types of loans in Pierce County with the following outcomes:

Local Impact

Craft3 is invaluable to GTCF in the due diligence, risk management, and outcome measurements they perform. But the intangible outcomes are just as valuable. As John Berdes acknowledges: “The bigger story is not about one loan, it’s about a portfolio of loans. And those loans connect to other outcomes.”

Here are just several examples of the harder-to-quantify outcomes generated by Craft3 borrowers:

- A florist sells crafts made by local artisans to complement their primary line of business, providing a distribution channel that wouldn’t otherwise exist for local makers.

- A machine shop supplies numerous large, local businesses, keeping money circulating in our local economy.

- A food business buys from local farmers, supporting agriculture in our region, cutting costs, and minimizing environmental damage from long-distance transport.

- Minority-owned businesses are more likely to employ minorities as they grow.

Additionally, when these borrowers complete their loan payments to Craft3, their credit will be restored and their growth possibilities significantly expanded. They will be able to access lower-cost financial services, and just as important, their self-image and confidence as entrepreneurs will be strengthened.

These anecdotes speak to, what I like to call, the “economic cascade” that is created when we invest in local businesses. This expanded view of the impact of our investments is crucial to GTCF’s involvement. We believe that developing new channels for the underserved to access capital will play a vital role in the resilience of our community.

The Long View

GTCF is committed to creating a more vibrant Pierce County using all the tools at our disposal – grants, scholarships, and impact investments. But even with this robust toolkit, we know that change does not happen overnight and we look for partners willing to make a long-term commitment.

Craft3, like the National Development Council, operates with a deep understanding of the long arc of change. Berdes reflects on Craft3’s past: “We are able to look objectively at our two-decade history… and actually point to tipping points of change not just measured by dollars and cents, but by community vision and confidence.” GTCF will work hard with all our impact partners to replicate these same results in Pierce County.

The final story in this series will look to our impact investing strategy and objectives in the coming year; it will appear on our blog in January. In the meantime, please do not hesitate to contact me with any questions.

Gina Anstey, VP Grants & Initiatives

[email protected]